amazon flex quarterly taxes

AMZN today announced financial results for its first quarter ended March 31 2020. For example if youre in the 24 tax bracket and earn 50000 from Amazon Flex youll owe 12000 in federal income taxes 50000 x 024.

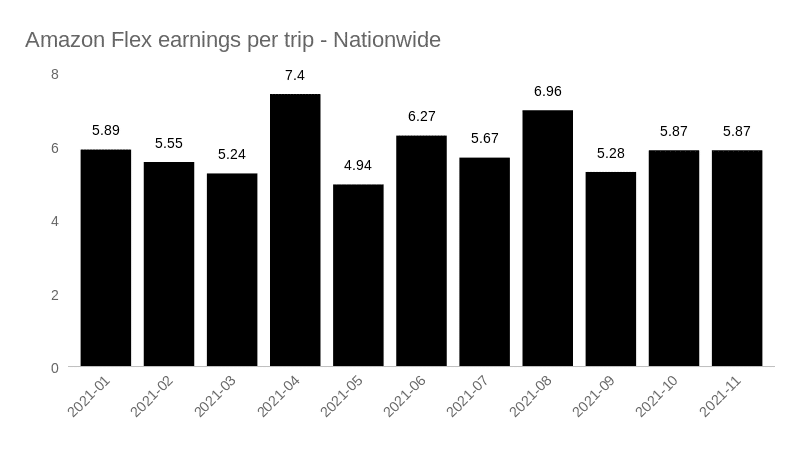

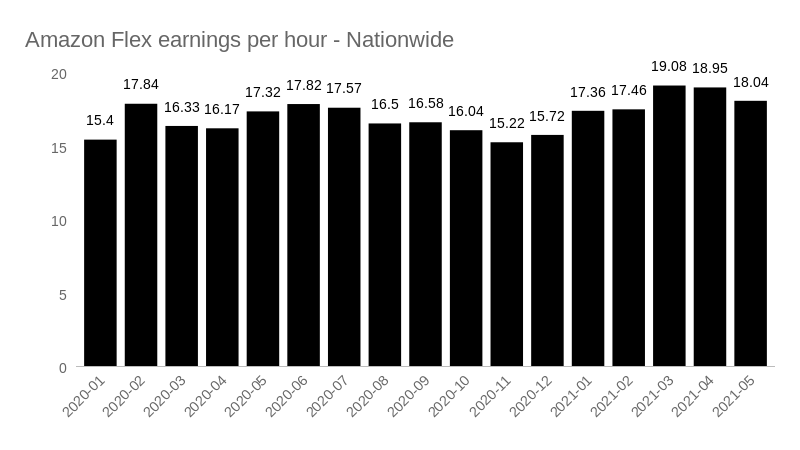

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

In most cases your TIN is either an Employer Identification Number EIN or a Social Security Number SSN.

. In addition to the federal taxes that we just discussed youll also need to pay state taxes. Louis MO Boston MA Salt Lake City UT. Amazon Flex pays out earnings on a weekly basis for base pay and tips for the previous 7 days on every Wednesday.

You are required to provide a bank account for direct deposit which can take up to 5 days to process. Amazon income taxes for the twelve months ending March 31 2022. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits.

Tap Forgot password and follow the instructions to receive assistance. For invoicing orders Amazon is required to report on the. Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022.

Drive a Fuel-Efficient Vehicle. The 153 self employed SE Tax is to pay both the employer part and employee. This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program.

The form will be filled out by Amazon who is required to provide. Gig Economy Masters Course. The IRS Form 1099-K is generated from your Selling on Amazon activity Amazon Pay Mechanical Turk MTurk and Flexible Payments Systems FPS plus Invoicing.

Work During the Holiday Season. So if you have other income like W2 income your extra business income might put you into a higher tax bracket. 12 tax write offs for Amazon Flex drivers.

Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. So you make 100 for 3 hours of work increasing your rate from 20 an hour to around 33 an hour.

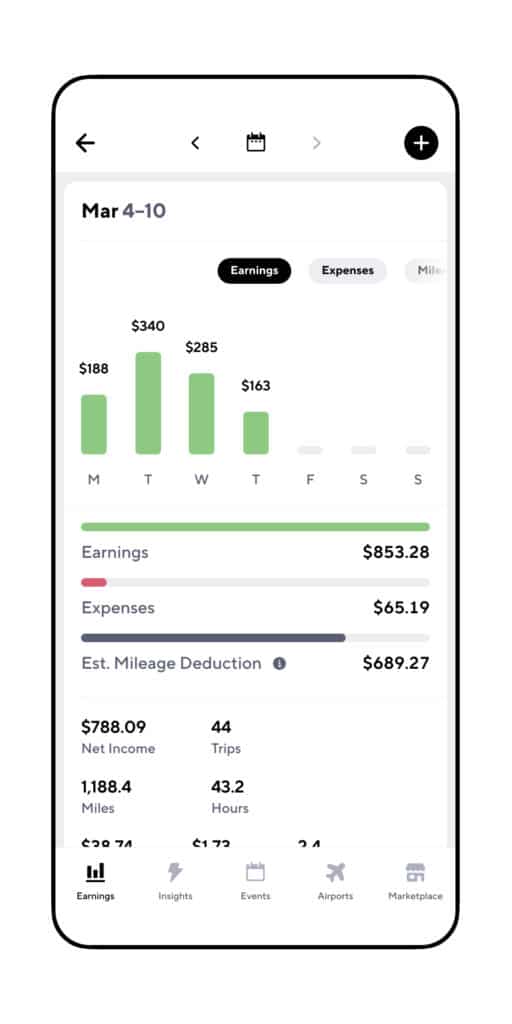

Income taxes can be defined as the total amount of income tax expense for the given period. Amazon Flex drivers can make between 18 and 25 per hour delivering packages. By completing the Tax Interview in your seller account you will be providing Amazon the appropriate tax identity in the form of a W-9 or W-8BEN form.

Amazon Flex quartly tax payments. You can plan your week by reserving blocks in advance or picking them each day based on your availability. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400.

Taxpayers a TIN is required by the IRS for the administration of tax laws. The amount of tax and National Insurance youll pay will depend on how much money is left over after deducting your flex expenses tax allowances and reliefs. Report Inappropriate Content.

Choose the blocks that fit your schedule then get back to living your life. Your 1099-NEC isnt the only tax form youll use to file. Get to the Fulfillment Center Early.

Just claim the 1099 next year. Operating cash flow increased 16 to 397 billion for the trailing twelve months compared with 344 billion for the trailing twelve months ended March 31 2019. The 1099-K form is your best friend.

This includes things like sales tax and shipping fees. Work During Inclement Weather. Individual online sellers are not responsible for filling out a 1099-K.

Class 2 National Insurance is paid as a set weekly. Organize Your Packages Ahead of Time. Knowing your tax write offs can be a good way to keep that income in your pocket.

Amazon annualquarterly income taxes history and growth rate from 2010 to 2022. Increase Your Earnings. Income tax starts at 20 on all your income not just from amazon over 12500 and 40 over 50000.

If youre looking for a place to discuss DSP topics head over to ramazondspdrivers. We are actively recruiting in. Take Advantage of Reserve Shifts.

To make sure you do this right just look through your bank statements and add up your direct deposits from Amazon Flex. Individuals C corporations sole proprietors single-member LLCs or LLCs taxed as corporations are required to file taxes by. The 1099-K is a sales reporting form that provides the IRS with your monthly and annual gross sales information.

Yes Amazon Flex Drivers Really Can Make 25 per Hour. Once your direct deposit is on its way Amazon Flex will send you an email to let you know. If youre looking for a place to discuss DSP topics head over to ramazondspdrivers.

Unfortunately youll still have to report your income to the IRS even without a 1099. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone.

Calculates Quarterly Tax Estimates on the basis of the already-enrolled information and keeps you on-schedule with payments. Select Sign in with Amazon. FilingPaying Self-Employment Taxes.

Our guide will help you get started. The IRS Form 1099-K you received is reported based on the information you provided during the US tax identity interview. Sign out of the Amazon Flex app.

This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. Fill out your Schedule C. Write Your Gas and Repairs Off as a Business Expense.

How to Calculate Your Tax. Amazon Flex Drivers are considered 1099 non-employee workers which is a separate taxpayer status from the classic W-2 salaried employees who work for someone else. If youre an Amazon seller living in the US then youre probably aware that tax time is coming up.

But instead of it taking you four hours to make all of your deliveries you managed to make them in three hours. Driving for Amazon flex can be a good way to earn supplemental income. Its a progressive tax which means that the amount of tax youll owe depends on your income bracket.

Amazon income taxes for the quarter ending March 31 2022 were -1422B a 16596 decline year-over-year. You may also need to file quarterly taxes. With Amazon Flex you work only when you want to.

You only need to do quarterly taxes if youre going to be above 1000 owed on your yearly return. And Amazon pays you 25 an hour so 100 for the whole block.

How Much Do Amazon Flex Drivers Make Gridwise

How Amazon Build One Day Shipping Digital Laoban

How To Do Taxes For Amazon Flex Youtube

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

An Amazon Flex Delivery Driver In His 60s Making 120 A Day Shares What It S Like To Work Independently For The Retail Giant Warehouse Automation

Drivers For Amazon Flex Can Wind Up Earning Less Than They Realize The Seattle Times

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How Many Packages Does Amazon Flex Give You

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

Amazon Flex Filing Your Taxes Youtube

![]()

How Quickly Do I Get Paid Through Amazon Flex Money Pixels

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

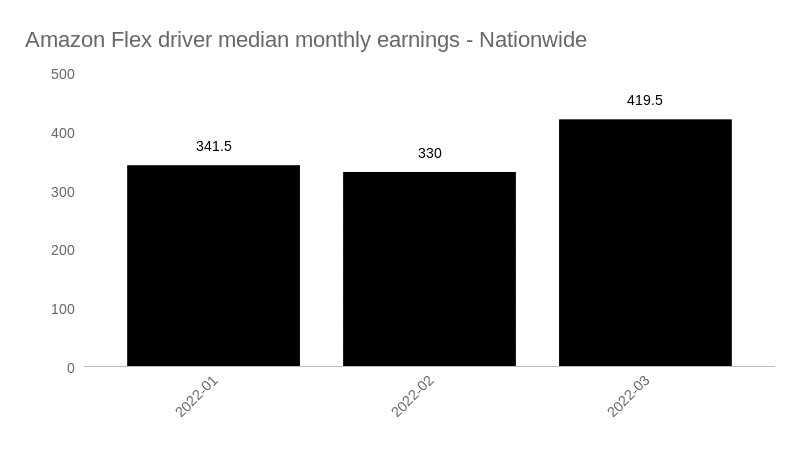

Amazon Flex Driver Pay Q1 2022 What Is Amazon Paying Their Drivers Gridwise

How Much Do Amazon Flex Drivers Make Gridwise

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How Much Do Amazon Flex Drivers Make Gridwise

Amazon Flex Driver Pay Q1 2022 What Is Amazon Paying Their Drivers Gridwise